Blue Cross / Medical

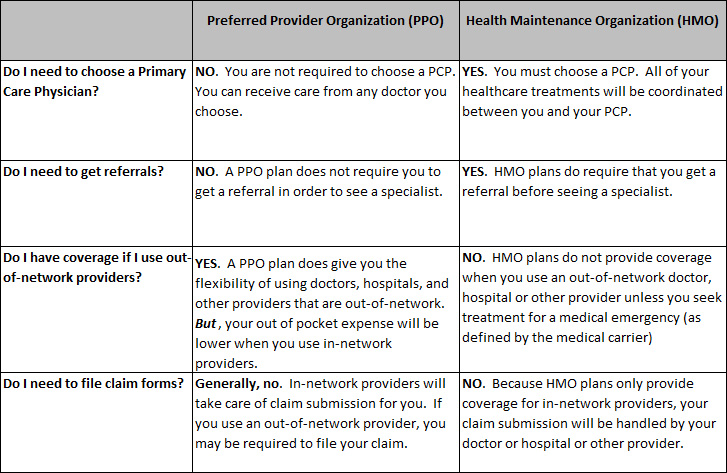

The Plan provides medical coverage through two different medical plans offered by Independence Blue Cross. You may choose either Keystone Health Plan East, a health maintenance organization (“HMO”), or Personal Choice, a preferred provider organization (“PPO”). Here’s a brief description of the differences between the PPO plan and the HMO plan, to help you determine which plan best meets the needs of your family.

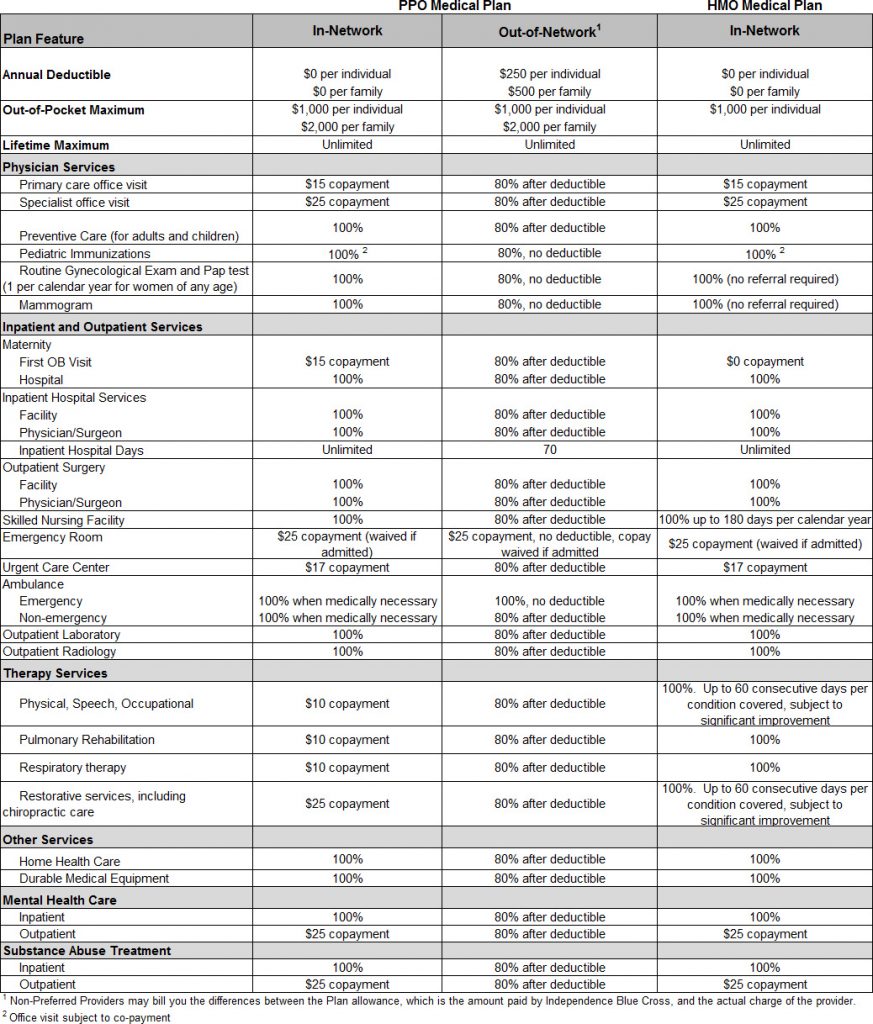

Summary of Medical Plan Benefits

Here is a summary of the benefits provided under the PPO and the HMO medical plans. For additional details on any benefit limit or exclusions please contact Independence Blue Cross or the Plan office.

Acupuncture Benefit –

Acupuncture benefits have been added to our plan and is covered under both Personal Choice and Keystone HMO

Your co-pay for in-network visits are $25.

Out of Network visits are not covered under Keystone HMO.

Out of Network PPO visits for Personal choice – you are responsible for the first $250 and 20% for each visit after the deductible is met.

- This is part of our overarching strategy to implement initiatives helping fight the opioid epidemic and offer more creative solutions for treatment

- Capped to 18 visits/year

- Limited to 6 medically necessary diagnoses:

- Headache (migraine, tension)

- Post-operative and chemotherapy-induced nausea, vomiting

- Nausea of pregnancy

- Low back pain

- Pain from osteoarthritis of knee/hip

- Chronic neck pain

Identification Card

Once you complete the PPO or HMO enrollment form provided by the Plan office, you will receive an identification card directly from Independence Blue Cross. This ID card is for medical benefits only. Be sure to keep your ID card with you because you will need it when you receive medical care. Your Blue Cross ID card also includes phone numbers and other important information about your coverage.

Pre-Authorization of Certain Medical Care

Whether your choose the PPO or HMO, your plan includes a pre-authorization program designed to ensure that you receive the care you need, in the most appropriate setting, while avoiding unnecessary treatment.

Generally, in-network providers handle the pre-authorization process for you. If you use an out-of- network provider (PPO only, since out-of-network treatment is not covered in the HMO) YOU are responsible to confirm that your provider has pre-authorized required services. You may be responsible for a financial penalty if you do not preauthorize services when you use an out-of-network provider. There is a $1,000 penalty for failure to preauthorize inpatient services or treatment, and a 20% reduction in benefits for failure to preauthorize outpatient services or treatment.

Procedures that require pre-authorization include but are not limited to:

- Non-emergency hospital admissions (except maternity)

- Certain outpatient surgical procedures, for example:

- Cataract surgery

- Hemorrhoidectomy

- Arthroscopic knee surgery

- Tonsillectomy and/or adenoidectomy

- Transplants

- MRI/MRA

- CAT Scan

- PET Scan

- Nuclear Cardiac Studies

- Outpatient Therapies

- Non-emergency ambulance

- Infusion Therapy in home setting

This list includes some but not all of the treatment that requires pre-authorization. For complete details contact Independence Blue Cross at 1-800-ASK-BLUE. If you decide to receive treatment after review and written notification that the medical service or treatment is not authorized, benefits will not be provided and you will be financially responsible for non-authorized benefit expenses.

Open Enrollment

Each year, the Plan will give you advance notice of the “open enrollment” period. Currently, open enrollment runs through the month of November, with any changes you make effective the following January. During this time, you can change from one medical plan to the other. For example, you can move from the HMO plan to the PPO plan. Before making any change, the Trustees urge you to consider carefully each plan’s differing levels of co-payments, benefits and plan limits. If you have questions about your coverage or need additional information, please call the Plan office at 215-440-4421 or 215- 440-4422.

Medical Expenses NOT Covered

Common examples of treatments, services and supplies that are not covered under the PPO and HMO medical plans include charges that are:

- Not medically necessary and appropriate, as determined by Independence Blue Cross

- Not billed and performed by a provider properly licensed and qualified to render the medically necessary treatment, service, or supply

- Experimental or investigative in nature

- Incurred prior to your effective date of coverage under the Plan

- Incurred after your coverage terminates

- For any loss sustained or expenses incurred during military service while on active duty, or as a result of enemy action or act of war, whether declared or undeclared

- That you have no obligation to pay

- For any illness or injury eligible for or covered by any federal, state, or local government program, Workers’ Compensation Law, or Occupational Disease Law or Act (this exclusion applies whether or not you claim the benefits available)

- For any occupational illness or injury

- For drugs or medicines covered under a freestanding prescription drug plan or program

- Rendered by a provider who is a member of your immediate family (“immediate family” means the member’s spouse, parent, child, sibling, or in-laws, including mother, father, sister, brother, daughter or son-in-law)

- For surgical procedures for cosmetic purposes that are done to improve appearance and from which no improvement in physiologic function can be expected; however, benefits are payable to correct a condition resulting from an accident, or to correct functional impairment resulting from a covered disease, injury, or congenital This exclusion does not apply to mastectomy- related charges as provided for in this description

- For telephone consultations, for failure to keep a scheduled visit, or for completion of a claim form

- For custodial care

- For assisted fertilization techniques – including, but not limited to, artificial insemination, in-vitro fertilization (IVF), gamete intra-fallopian transfer (GIFT), and zygote intra-fallopian transfer (ZIFT)

- For personal hygiene and convenience items including, but not limited to, air conditioners, humidifiers, physical fitness or exercise equipment, television, guest trays, wigs, chairlifts, stair glides, elevators, spa or health club memberships, whirlpool, sauna, hot tub or equivalent device, whether or not recommended by a provider

- For acupuncture – unless you meet the criteria listed above for the 6 medically necessary diagnoses and limited to 18 visits per year.

- For care in a nursing home, home for the aged, convalescent home, or custodial care in a skilled nursing facility

- For inpatient private duty nursing services

A full description of your medical coverage, including any benefit exclusions and limitations can be provided to you directly by Independence Blue Cross. Except for issues relating to eligibility for benefits and plan administration, if there is a conflict between the Independence Blue Cross information and this booklet in the description of the medical benefits available from the Plan, the materials from Independence Blue Cross will govern.

Filing Medical Claims

When you use in-network providers, you do not need to file claim forms because in-network providers file required forms directly to Independence Blue Cross. Since the HMO provides only in-network coverage, you should not need to worry about filing any claim forms for medical benefits. Since the PPO provides coverage both in- and out-of-network, filing a claim for benefits with Independence Blue Cross may be your responsibility if you use an out-of-network provider.

Appealing a Claim Denial

The Plan has specific procedures that must be followed if your claim is denied and you wish to appeal that decision. Generally, you must appeal a denial of benefits within 180 days but there exceptions for urgent claims and for pre-authorization of medical claims. Additional information on the appeals process is included under the section entitled “Your Rights under the Plan”

FAQ – Medical

Does Local 22’s Health Plan offer more than 1 medical plan?

Yes – Local 22’s Health Plan offers a PPO – Personal Choice and an HMO – Keystone Health Plan East.

Can we go to any doctor we want?

The answer depends on the plan you have enrolled in.

Keystone Health Plan East is an HMO that requires you to choose a primary care physician. You and your primary care physician will coordinate your healthcare treatments. You are required to get a referral from your primary care doctor before you can see a specialist. You will not be covered in for any out of network service unless it was for emergency service.

Personal Choice is a PPO. PPO’s provide you with the flexibility to see any doctor. You will not need a referral to see a specialist. You may see out of network providers but the out of pocket cost could be considerably higher

For more information on Blue Cross Plans and benefits

- Link – www.ibx.com

- Personal Choice – 215-557-7577

- Keystone HMO – 215-241-2240